How do you capitalize on betting opportunities? Enter expected value betting. This analytical approach enables you to identify wagers that are statistically more likely to pay off over time. In this article, we dissect the intricacies of expected value, providing a blueprint for its practical application in everyday betting scenarios. You’ll learn how to calculate it, why it’s essential for sustained profit, and the nuanced tactics that can elevate your betting strategy — all with clear-headed advice.

Key Takeaways

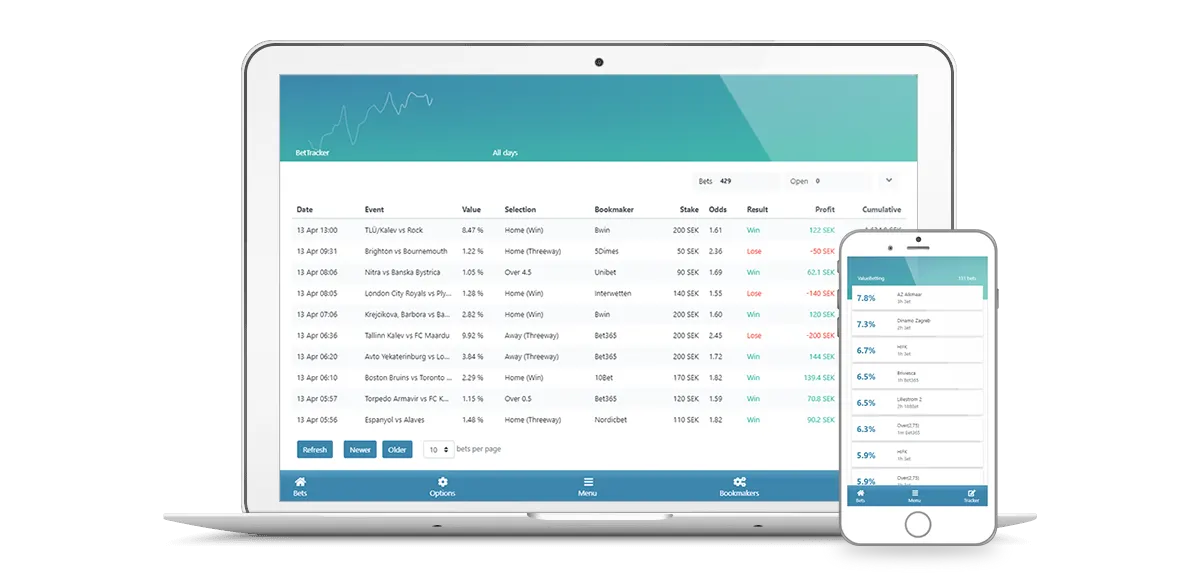

What is RebelBetting?

RebelBetting offers sports betting tools that help you turn sports betting into an investment. By using RebelBetting you can turn the bookmakers’ own odds against themselves, finding profitable bet situations where you have the edge.

This is called value betting and sure betting.

Understanding the Fundamentals of Expected Value (EV) in Sports Betting

Expected Value (EV) in sports betting is a concept that predicts the average outcome of a bet if placed repeatedly, accounting for all potential results and their associated probabilities. Essentially, EV reflects the average amount a bettor can expect to win or lose per bet over an extended series of wagers at the same odds.

Understanding EV is critical as it represents the average return, i.e., profit or loss, from continuing to place the same bet multiple times. Grasping the concept of expected value is an essential building block in constructing a successful sports betting strategy.

Defining Expected Value and Its Role in Betting

At its core, Expected Value (EV) measures a bettor’s theoretical average profit or loss per bet when that bet is placed repeatedly over time. It indicates the long-term outcome of your betting strategy, taking into account both the size of your potential winnings and the likelihood of you winning.

The beauty of EV lies in its ability to differentiate between profitable and unprofitable betting opportunities. A positive EV indicates bets that, when placed consistently over time, are expected to yield a profit, while a negative EV suggests bets that are more likely to result in losses. However, it’s crucial to remember that identifying bets with value through EV calculation does not guarantee instant profit, as expected value is a predictive measure based on the likelihood of potential outcomes over a series of repeated bets.

The Mathematics Behind EV

Now, let’s delve into the mathematics behind EV. To calculate the expected value, start by multiplying the probability of winning with the potential win per bet and then subtracting the probability of losing multiplied by the potential loss per bet. It might sound complicated at first, but with a little practice, it becomes relatively straightforward.

However, there’s a catch. The odds offered by bookmakers include their profit margin, also known as the vig, which gives the sportsbook an edge over bettors. This vig is applied to each market, causing the implied odds to exceed 100%, representing the bookmaker’s profit margin. To get around this, we use no vig fair odds to find the true odds sans bookmaker’s margin when calculating the expected value.

Positive vs. Negative Expected Value

When it comes to EV, not all bets are created equal. A positive expected value (+EV) in betting implies the probability of profit over time from the opportunity presented. For instance, if you’re being offered odds of 2.15 for a fair coin toss, this indicates a value bet where the potential return is higher than what is suggested by the odds. Even if it loses, a positive EV bet provides a higher return than what the odds indicate should be the case, reflecting a profitable opportunity.

On the other hand, a negative expected value (EV) implies that a bettor would lose money over time. This is often the case with bookmaker set odds, for example, around 1.90 for both outcomes of a coin toss. Differentiating between positive and negative expected value is crucial, as +EV indicates profitable opportunities while -EV suggests bets that will lose money over time.

Statistics from Value betting users

The Strategy of Value Betting

Armed with an understanding of EV, we can now explore the strategy of value betting. Value betting involves placing bets that have a greater chance of winning than the odds imply. This means that you’re not just betting on who you think will win, but on who you think has a greater chance of winning than the odds suggest.

By consistently engaging in value betting, you improve your likelihood of being profitable over the long term. To achieve this, it’s essential to incorporate the concept of expected value into your sports betting strategy to overcome the bookmaker’s advantage and achieve profits over time.

Identifying Overpriced Odds

The first step in value betting is identifying overpriced odds. An overpriced odds offer exists when a bettor’s estimated probability for an event is higher than the implied probability derived from the bookmaker’s odds. In simpler terms, you believe an outcome is more likely to occur than what the bookmaker thinks. If the bookmaker’s odds are higher than what you believe to be the true probability of an event, this suggests that the bet is overpriced and offers a positive expected value.

To estimate the true probabilities of outcomes, bettors use tools such as:

By calculating percentages and converting them to odds, you can make direct comparisons. For instance, if your analysis gives an event a 50% chance (2.0 odds) but the bookmaker offers odds of 2.2, this indicates a potential value bet. Assessing your own probability estimates can help you identify these opportunities.

The Kelly Criterion: Optimizing Bet Size

Once you’ve identified a value bet, the next step is determining how much to wager. Here’s where the Kelly Criterion comes into play. This betting strategy uses a mathematical formula to calculate optimal bet sizes, aiming to maximize bankroll growth by considering the probability of winning and the odds offered. It helps to determine the most suitable amount to wager based on the bet’s perceived value and the bettor’s total bankroll.

By applying the Kelly Criterion, you can establish the percentage of your bankroll that should be wagered on a particular bet, taking into account the bet’s perceived value and probability of winning. It helps adjust bet sizing proportional to the bet’s percentage expected value (EV), enabling bettors to manage risk effectively while taking advantage of such EV opportunities. While the original Kelly Criterion can recommend aggressive bet sizes, bettors can use modified versions, such as the Half-Kelly or Quarter-Kelly, to suggest smaller bet sizes and mitigate risk.

Navigating Bookmakers for Best Value

Selecting the right bookmakers is a crucial aspect of value betting. A variety of factors should be considered, including the odds offered, the diversity of markets available, and the quality of the betting lines, especially when betting in niche markets. Maintaining multiple bookmaker accounts allows you to take advantage of the best odds available across the betting market. It’s recommended to have at least three bookmakers to start value betting.

Different types of bookmakers operate in unique ways. For instance, ‘market maker’ bookmakers significantly influence the setting of lines, while ‘soft’ bookmakers often adjust their lines more slowly, creating opportunities for value betting. However, bear in mind that betting into small theoretical edges can lead to higher variance, requiring a high volume of bets to achieve bankroll growth.

Subscribe today

Start using the fastest, most user-friendly, value betting and sure betting service on the market. At any given time, RebelBetting finds thousands of profitable bets for you to bet on.

P.S. To get the best possible offer make sure you join for a longer period of time – up to 30% off.

RebelBetting Pro

- Value bets & sure bets

- Maximize your profit

- The most profitable bets

- Access non-limiting bookies

RebelBetting Starter

- Value bets & sure bets

- Great when starting out

- ROI over 30% / month

RebelBetting Pro

- Value bets & sure bets

- Maximize your profit

- The most profitable bets

- Access non-limiting bookies

RebelBetting Starter

- Value bets & sure bets

- Great when starting out

- ROI over 30% / month

Calculating Expected Value Like a Pro

Now that we’ve covered the basics of EV and value betting, let’s delve into the process of calculating expected value like a pro. This involves:

From Odds to Probabilities: Converting Betting Lines

Converting betting odds to probabilities is a critical step in EV calculation. To do this, you divide 1 by the odds for decimal formats, turning betting odds into a percentage indicating the likelihood of an outcome according to sportsbooks.

Once odds are converted to probabilities, these can be used in expected value calculations to identify bets with positive values. This allows for strategic betting decisions, as you’re effectively comparing your opinion on the likelihood of an event happening with the bookmaker’s opinion.

Applying Real-World Examples

Let’s put this into context by applying EV calculations to real-world betting examples. Suppose you place a $100 bet on the Los Angeles Rams at +110 odds when the fair odds with no vig are +100. In this situation, the expected value of the bet is calculated to be $5.

By examining a straightforward example such as a coin toss, where the expected value of a bet at +110 odds is $5 for a $100 stake, bettors can grasp the fundamental concepts behind expected value.

Applying expected value calculation to real-world betting helps bettors make informed decisions and identify profitable betting opportunities.

Advanced EV Betting Tactics

While understanding EV and value betting forms the foundation of profitable betting, to truly excel, you need to embrace advanced EV betting tactics. These tactics take a range of factors into account, including:

By considering these factors, you can make more informed and strategic bets, increasing your chances of success.

Assessing Market Movements and Closing Line Value

One advanced tactic involves assessing market movements and closing line value (CLV). The closing line represents the most accurate odds as it reflects the cumulative information and market consensus at the start of the event. By comparing the odds at the time of bet placement with the closing line, you can determine if a bet has ‘closing line value’ (CLV), indicating a profitable bet.

Furthermore, by monitoring market movements, you can identify potential value betting opportunities. Shifts in odds might reveal that other market participants have detected a value situation, allowing you to exploit these opportunities for potential profit.

Thorough market analysis is crucial in EV betting, which includes studying line movements, understanding how odds are set by bookmakers, and recognizing patterns in public betting behavior.

Specializing in Niche Markets for Better Odds

Another advanced tactic is specializing in niche betting markets. Betting on less popular sports or leagues, such as women’s basketball, PGA golf betting, or college football, can offer better value bets due to less attention from casual bettors and bookmakers. Bookmakers may not be as well-informed on these smaller sports or leagues, which creates an opportunity for knowledgeable bettors to benefit from potentially favourable odds.

Niche markets are more likely to contain errors in odds compared to major sports, offering an opening for bettors to exploit these discrepancies for profit. However, be aware of the higher risk of facing betting limits or restrictions when you consistently win large stakes in niche markets due to the lower overall betting volume.

Risks and Realities of Pursuing Positive EV Betting

As with any form of betting, pursuing positive EV betting comes with its own set of risks and realities. It’s essential to manage expectations and understand the impact of variance on your results. Betting is inherently uncertain, and even with a positive EV, individual bets can still result in losses.

Winning is not guaranteed, and bettors should not expect every bet with a positive EV to be a winner.

Managing Expectations and Variance

Variance refers to the spread between expected and actual outcomes of bets over a short period. In the short term, bettors may experience both winning and losing streaks, regardless of the positive expected value of their bets. A clear understanding of variance can help keep you level-headed, preventing you from second-guessing your strategies during downswings.

Even with a positive EV, individual bets can still result in losses, and winning is not guaranteed. Bettors should not expect every bet with a positive EV to be a winner. It’s important to track and analyze results from placed bets to verify the profitability and consistency of a Positive Expected Value betting strategy.

To handle variance, follow these steps:

The Long-Term Perspective of EV Betting

In the realm of EV betting, it’s crucial to shift your focus from short-term gains or losses to long-term outcomes. While identifying and consistently placing positive EV bets is critical for long-term profitability in sports betting, value betting doesn’t guarantee long-term success. But gambling without EV considerations assures long-term failure.

Given the impact of variance, focusing on long-term outcomes rather than short-term deviations from expected results is essential. Remember to set probabilities for games, find +EV bets, and track their outcomes to test and practice expected value betting methods.

Turn sports betting into investing

RebelBetting lets you outsmart the bookmakers at their own game by finding profitable odds where you have the edge

Building Your EV Betting Toolkit

To maximize your profits, it’s crucial to build an effective EV betting toolkit. This involves leveraging betting software and algorithms, as well as conducting extensive research and analysis. With such tools, you can automate the search for bets, manage the tracking of bets and their outcomes, and enhance your EV betting process.

Leveraging Betting Software and Algorithms

Advanced betting software like RebelBetting can significantly enhance your EV betting process. By using advanced algorithms, which include machine learning and artificial intelligence, RebelBetting can analyze odds from different bookmakers, compare these odds to identify value bets, and calculate optimal stakes.

Custom betting solutions can offer several benefits for bettors, including:

Using RebelBetting’s value betting software, bettors can expect an average ROI of over 30% per month. Additionally, there is a profit guarantee where if no betting profit is made in the first month, another month is offered for free.

Conducting Extensive Research and Analysis

In addition to leveraging advanced tools, conducting extensive research and analysis is crucial in making more realistic betting choices that consistently yield positive EV. Using a logistic curve model helps bettors filter bets and reconcile the bet’s potential payoff with the actual likelihood of winning to identify truly valuable bets.

To discern value bets with positive expected value, bettors need to be well-informed on factors like injury updates and trends that could significantly impact the game outcome and betting calculations. Applying disciplined filters can aid bettors in making more realistic betting choices that can consistently yield positive EV, considering even the vig charged by sportsbooks.

Summary

In this article, we’ve taken a deep dive into the fascinating world of Expected Value (EV) betting. From understanding the fundamentals of EV in sports betting to advanced tactics, we’ve covered the A-Z of profitable betting. We’ve also discussed strategies like the Kelly Criterion, value betting, and the significance of focusing on the long-term perspective rather than short-term results.

While EV betting is not a guaranteed route to riches, it offers a systematic and mathematical approach to sports betting that can increase your chances of becoming a profitable bettor. By understanding the concept of EV, identifying value bets, and adopting a disciplined betting approach, you can maximize your potential winnings and make the most out of your sports betting experience.