Profit from both investment methods

For everyone who has already grasped the concept of making money with arbitrage or value betting naturally comes the question: which of the two strategies is the right one for me? Indeed, while the two strategies are very similar in their approach to finding value, the fact that an arbitrage bet is hedged while a value bet is not, has great implications on the two strategies’ risk/return profiles.

A more risk-averse bettor would mostly enjoy the steady returns of an arbitrage (sure betting) strategy. A risk-tolerant one would be happy to increase his or her investment returns at the price of the high volatility that is typical for a value betting strategy.

The best thing is, when signing up for RebelBetting you will access both methods!

So, which one is right for you? Let’s dive deeper to find out.

Arbitrage betting / Sure betting

An arbitrage strategy, as supported by the arbitrage tool of RebelBetting, is a strategy, where a screening algorithm discovers value bets by searching for pricing errors on the betting markets. Each bet is then being paired with a low margin bet on the same event in the opposite direction. The combination of the two bets guarantees a profit, regardless of which way the event goes.

This is the classical betting arbitrage. Note that only one of the two bets in the arbitrage pair is a value bet, while the other one is a negative value bet serving only hedging purposes. While in a single event anything can happen, in the long run you are only making money from the value bet in the arbitrage pair and actually losing money on the hedging bet – though less money than you are making on the value bet.

This is the price you pay to have a sure profit on every bet and to buy yourself some peace of mind. Following an arbitrage strategy, you end up with a small sure profit and almost zero risk.

Value betting

A value betting strategy, which is just as well facilitated by the value betting tool of RebelBetting, is very similar to arbitrage in that the software again screens the market for those very same pricing errors resulting in positive value bets for you. However, here you completely skip the hedging bet. Skipping the hedging bet altogether has two very important implications.

First, you forgo paying the insurance price for stabilizing your returns and invest your money entirely in a positive value bet, therefore you maximize the expected return on your capital. Second, by completely giving up hedging your bet, on a single bet level you are at the mercy of lady fortune.

In the long run things always turn into your favor, courtesy of the positive value of your bets. Furthermore, your long run ROI is very predictable – it is a statistical certainty, that your return will closely match the positive value percentage of your bets, which is being neatly calculated and given to you by RebelBetting. But short term you are completely unhedged, should expect huge volatility and therefore take on the highest amount of risk possible.

Obviously, the most risk-avoiding punter will go for an arbitrage strategy and the most risk tolerant for a value betting one. You would be forgiven for not being able to spontaneously decide which of those two boxes you would put yourself into. After all, we are all different and most of us would find ourselves somewhere in the middle of that scale. The good thing is that you can try both investment methods for free by joining the 14-day free trials for both sure betting and value betting.

How to mix value betting and sure betting

The other good news is, there is a way to put together the right type of strategy for any amount of risk-tolerance. We do that by mixing value betting and arbitrage and giving just the right weight to each of them to have the risk/return profile that suits us the most.

But let’s first answer the practical question: how do you mix Value Betting and Arbitrage using the tools that RebelBetting offers? For this you can make use of the main functionality of RebelBetting, which is finding value. Once you know where the value lies, you have got two questions to answer.

First, how much would you like to bet on the value bet. The common sense answer is: as much as you can, given the practical limitations of betting limits and the size of your bank. Even if the exposure from the value bet is more than you can comfortably stomach, you can easily diversify the excessive risk with the hedging bet and turn it into an arbitrage profit!

While this principle holds true in general, there is an important exception to mention here. And that is, not every value bet has enough value to qualify as an arbitrage bet. And with those value bets that fall into that category, you cannot diversify the excessive risk at a profit. Which means you shouldn’t take the excessive risk in the first place. This is the only instance when you wouldn’t take on more risk on the value bet than you / your bank can tolerate. In this case you would simply use the Kelly criterion calculator from RebelBetting and bet the resulting stake or reduce it to suit your risk preference.

The second question is then, what part of the value bet to hedge and what part to let run. This one is more tricky to answer and you will find the guideline to do so below.

Pure arbitrage strategy

You could size your stake so that you have the same theoretical return on both legs of your arb regardless of which way the event goes. This is the classical arbitrage. Let’s see how it looks in practice. You receive a notification from the arbitrage service of RebelBetting for an arbitrage opportunity in the total goal market for the game Liverpool – Manchester City.

Bet365 offers over 3.5 goals at 1.90 and under 3.5 goals at 1.90. Meanwhile, at Pinnacle the current line is at 2.20 for the over and 1.75 for the under. RebelBetting detects an arbitrage opportunity for the event and lets you know that, if you act quickly enough, you can bet the over at Pinnacle and the under at bet365 for a sure profit.

Knowing your sharp from your soft bookmaker, you recognize that the value bet is at bet365 and the hedging bet in Pinnacle. You decide that a bet of €200 in bet365 wouldn’t attract too much attention while still being big enough to make the effort of placing the arb worthwhile. What do you do?

Sure bet example:

The result: you have bet 200 + 172.73 = €372.73 for a sure return of €380.00. You have made €7.27 of sure profit, before the event has even started.

Pure value bet strategy

What would a value bettor do? Knowing that the Bet365 bet is the value bet in this situation (again, this is easily recognisable since it is entirely bookmaker-dependent), the value bettor would just place his €200.00 bet in bet365 and call it a day. What would the expected value of such a bet be?

The Pinnacle odds let us know of the theoretical probability of each outcome happening. We find that figure out by clearing the Pinnacle odds from the margin. To get the true odds I like using the “margin proportional to odds” method as described by Miguel Figueres in his Value Betting Blog.

I like this method because it considers the well-documented favorite longshot-bias. Miguel describes the formula as: True odds= Outcomes * Odds / (Outcomes – Margin * Odds

Value bet example:

Which in our case translates the true odds for an under 3.5 goals in this event to:

2 * 1.75 / (2 – (1/2.20+1/1.75-1) * 1.75) = 1.79

The true probability is nothing more than 1 divided by the true odds, or:

1/1.79 = 55.844%

Applying this true probability and taking the favorable odds for the u3.5 that Bet365 is offering, we have an expected value of the probability of the outcome happening times the odds minus one or:

EV = 55.844% * 1.9 – 1 = 6.104%

This is an important number! The expected value is positive, which is good and means we have a value bet. Furthermore, the number 6.104% means that if we make this bet many times over, sometimes the bet will win and sometimes it will lose, but in the long term we would have a 6.104% return on our turnover.

A value bettor likes that! Notice that the return on investment is way higher in the value betting case than in the arbitrage case, where we only get €7.27 on €372.73 staked, or a mere 7.27 / 372.73 = 1.95%. What’s not to like?

It looks complicated…

But the mathematics of the value bet is really pretty simple. We assumed that the Pinnacle odds are the true odds (an assumption that research supports strongly) to calculate our EV. Furthermore, we skipped betting the Pinnacle odds, since you can’t make money on the true odds reduced by a margin – this would always be a negative value bet!

However, we also see the higher return on investment comes at a price. We don’t have a sure profit anymore. In the short term, our value bet can still lose – but you will always profit long term. Our next 5 or 10 bets can lose too, even if they are all EV+. Only after a certain amount of bets can we be reasonably certain that we will see a profit close to the EV of our bets – in the short term, we can be way below (or above that). This is the risk that the arber insures himself against in the form of the EV- Pinnacle bet.

The above example is just a simplified example to explain the rudimentary math behind a value bet. In real life, RebelBetting uses several more variables to calculate the value bet percentage, such as the margin, betting bias etc.

Profit Guarantee

We know our products work.

In fact, we are so confident about it that we offer a Profit Guarantee.

If you don’t make a betting profit in the first month you get another month for free.

Again and again until you profit. We take all the risk.

Examples of a mixed strategy

So how to best combine value betting and sure betting? Well, you neither have to be a pure arber, nor a pure value bettor. You can choose a path in between. You can only hedge a part of your exposure from the positive value bet and leave the rest open. In this way you can finetune the risk of your strategy exactly where you want it to be.

In the example above, you can bet your €200 in bet365 but hedge only €100 by betting only half of the amount in Pinnacle or €172.73 / 2 = €86.36. In this way you effectively have a “naked” value bet of €100, plus a sure arbitrage profit of €3.63. Your expected profit is somewhere in between the two strategies and your risk as well. Of course, you don’t have to hedge exactly half of your value bet – you can hedge as much of it as you like.

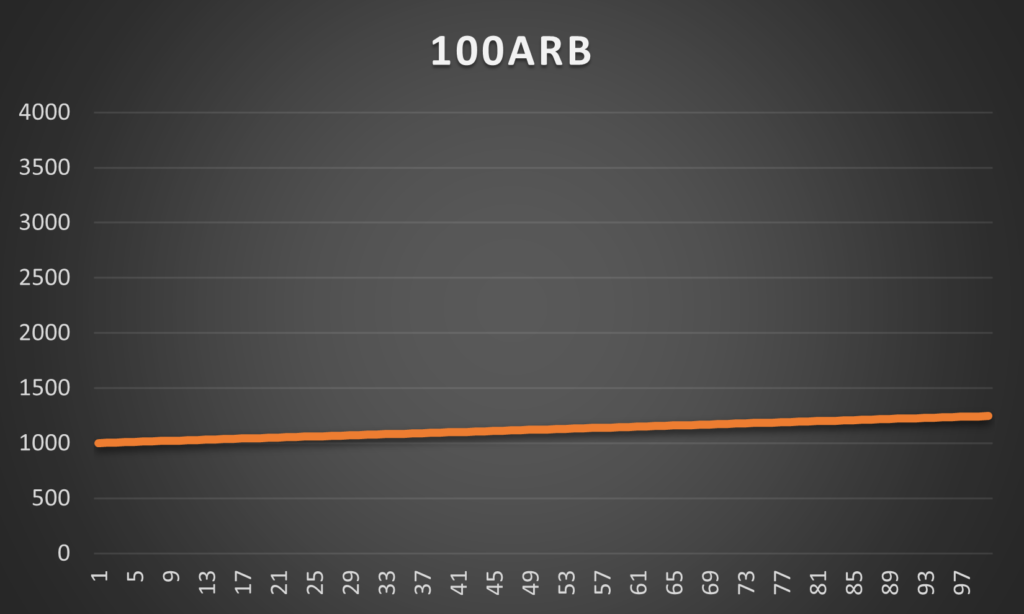

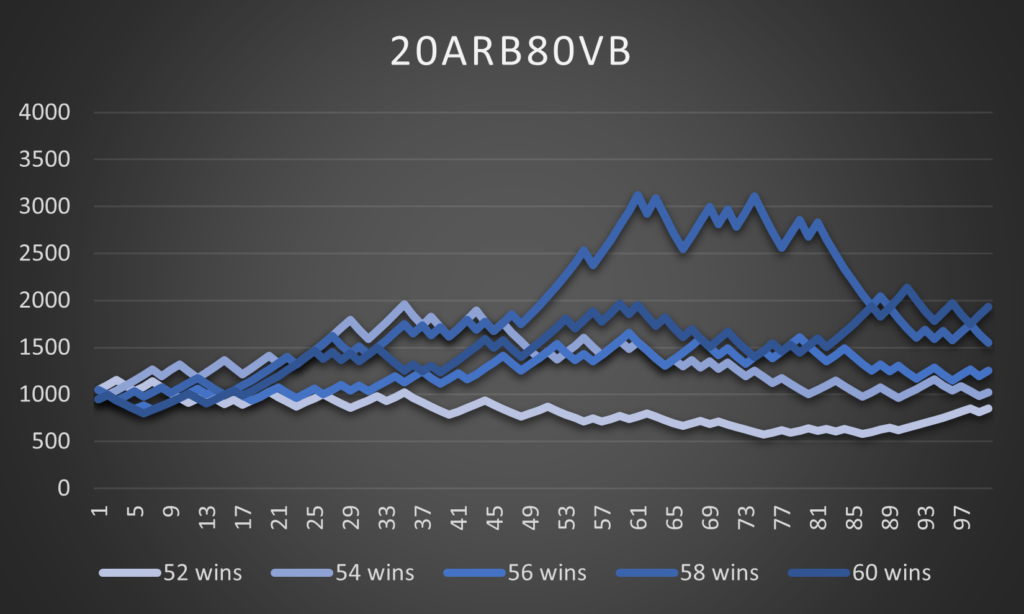

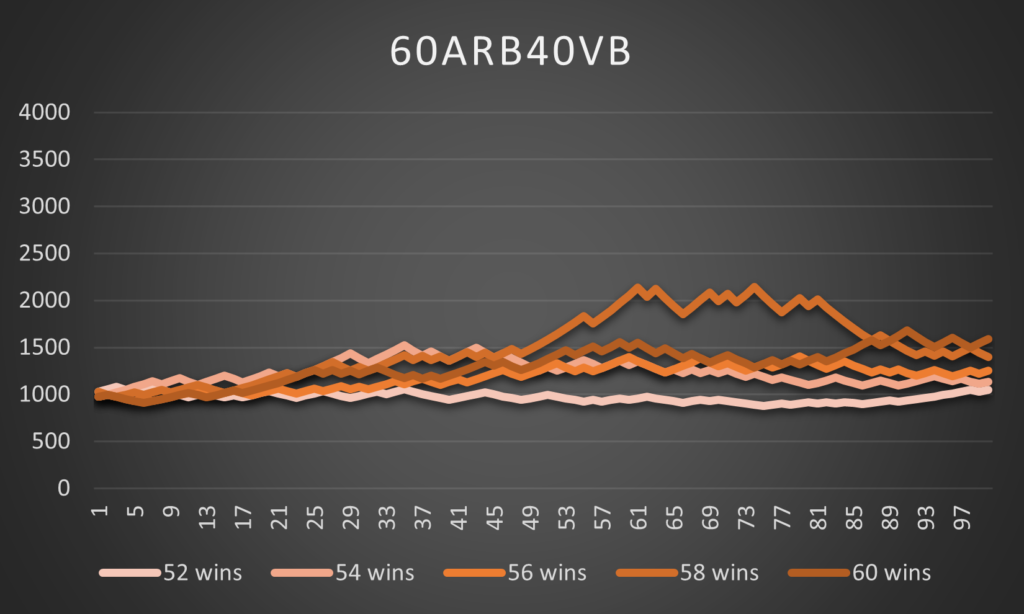

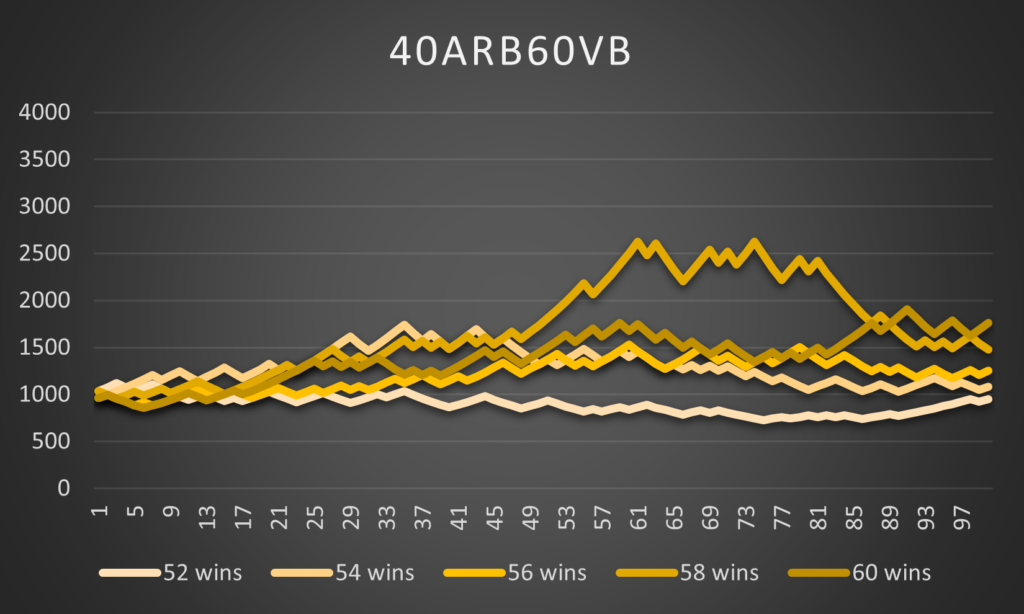

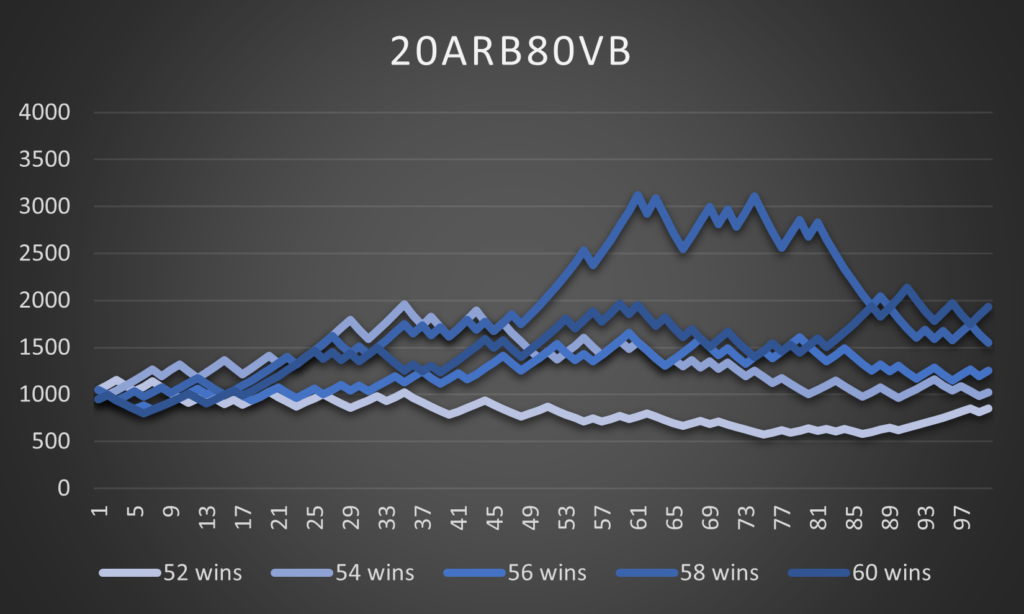

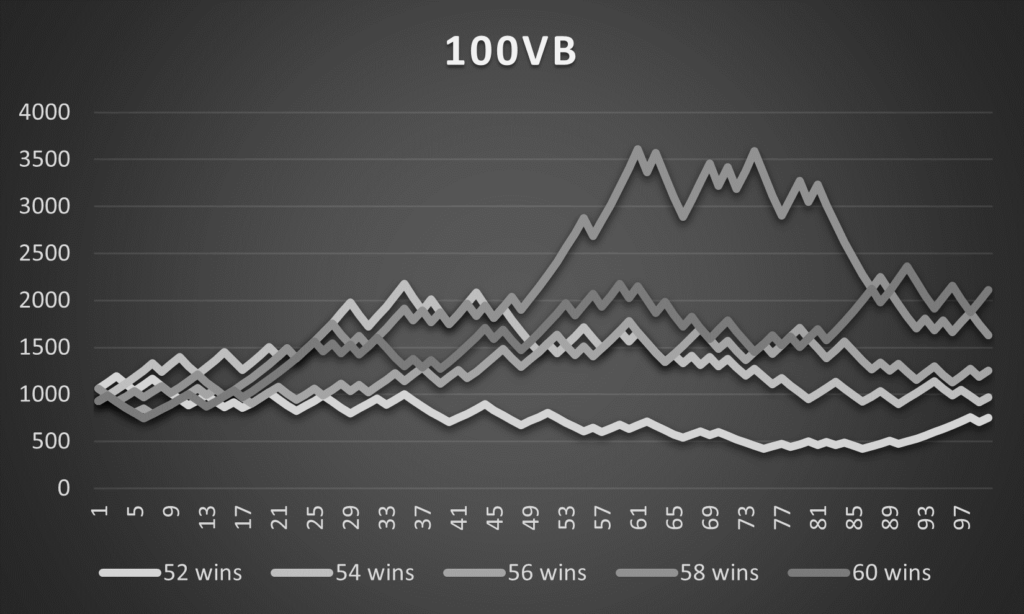

To illustrate the possibilities, I have run a simulation of 100 bets such as the one described above. In the two base cases, I once place the 100 bets fully hedged in a pure arbitrage fashion and once, I bet everything on the positive value bet as in a pure value betting strategy.

I also run 4 mixed strategies, where I hedge 20%, 40%, 60% and 80% of the value bet. I have simulated the series 5 times to show you the outcomes in different (positive and negative) scenarios. You can see how the results of each strategy vary depending on how lucky the bettor is. Remember I am betting the same 100 bets over and over again, so the variation in the winning percentage is pure luck. I have started with a bank of €1000 and stake 6.78% of my bank for each value bet. This is the optimal bank share to bet for such EV+ based on the Kelly criterion.

Pure arbitrage

80% Arbitrage 20% Value Betting

60% Arbitrage 40% Value Betting

40% Arbitrage 60% Value Betting

20% Arbitrage 80% Value Betting

Pure value betting

In an arbitrage strategy you don’t care about the event outcome at all, you always end up with €1246. In a pure value betting strategy, your results for the first 100 bets may vary between ending up with €748 up thus losing a quarter of your bank to more than doubling your bank with €2107 in the best scenario.

As you see on average you are better off with a value betting strategy, but in the short term anything can happen. Spending the time to place your first 100 bets and paying the subscription fee for the software, only to end up losing a quarter of your initial bank can be disheartening – and also a plausible scenario.

Therefore, hedging at least a part of your bets could be beneficial from a risk/return perspective – and also scientifically sound from a Kelly criterion point of view as this Pinnacle article proves.

Notes:

Some caution is warranted when interpreting the results above. Regardless of the strategy, I always wager the same amount on the value bet of the pair and stake additional money on the hedging bet. This is somewhat realistic, as often the main limitation in following those strategies will be how much you can wager on the value bet side.

Still, for the strategies heavier on the arbitrage side you would need to wager more capital, which is not visible in the graphs above but is clearly a disadvantage for those strategies. Furthermore, the number of 100 bets has been randomly picked and is low. Over a longer series, the value betting strategy will tend to overperform more often. However, I want to give the reader a realistic feeling for the kind of volatility that is possible with a value betting strategy over the long term.

Is weighting right for me?

This is not a trivial question and one that has been researched thoroughly in the area of finance, where economists have long asked the question: What is the optimal portfolio allocation for a given risk appetite?

According to classical financial theory, for every risk preference, there is an optimal mix of the risk-free asset and a diversified portfolio of risky assets. Similarly, there would exist an optimal mix between arbitrage and value betting for each and every punter. What the right weighting looks like for you is a very individual question. And yet, being aware of the possibilities presented above will ultimately lead you to the best solution.

If you want to maximize your returns without taking unnecessary risks, there is no way around mixing value betting and arbitrage. RebelBetting provides the necessary tools. All that is left for you to do is to try RebelBetting and fine-tune your optimal strategy. Before you know it, you will have settled into your preferred balance between arbitrage and value betting, or chose one method above the other. No matter the method you choose with RebelBetting, you can be sure to enjoy the steady flow of profits!

The best thing is, when signing up for RebelBetting you will access both methods!

We hope you found this article about how to best combine value betting and sure betting interesting. Check out more articles about value betting and more articles about sure betting on our help section pages.